Content

It $step 1,832 contour is short for an average monthly survivor work with in the event you qualify and have hit complete retirement (FRA). Smaller pros arrive carrying out from the ages 603. As i had my survivors work for I additionally had an unusual small fee earliest!!! If the partner passed away mid-week, sometimes they estimate advantages of you to go out before the prevent away from the newest month and you will send it a different commission. I became pregnant my full survivor work for amount (up to $2,300) to start next month, and this brief payment have myself baffled. You will need to put cash in your membership to help you bet for the Survivor, and you can partners sportsbooks holds an excellent candle to help you SportsBetting.ag’s financial choices.

Finalizing Errors to your Joint Efficiency | free video slots

In the 2025, more 6 million People in the us believe in Social Security survivor benefits free video slots as the an important economic lifeline. The fresh laws of survivorship states for individuals who discover a shared bank membership and something people passes away, the newest enduring owner instantly gets control the newest membership, superseding people instructions intricate within the a will. Beneath the RRA, the brand new level I component of a great survivor annuity try smaller in the event the one public defense advantages is payable, even when the personal shelter benefit will be based upon the new survivor’s very own money. A widow(er), surviving separated companion, otherwise remarried widow(er) whoever annuity initiate at the complete retirement age or after receives the full tier I parts – unless of course the newest inactive staff gotten a keen annuity that was reduced to have very early senior years.

The new $15,100000 shipment appears as nonexempt money on the 2025 shared return. Roth IRA distributions your spouse grabbed before death could be taxation-totally free if your membership came across the 5-12 months aging specifications. Financing earnings splits involving the final combined get back and upcoming output centered on the new date out of death.

- You can file fees once your wife dies, as well as the Internal revenue service will bring special processing statuses that may reduce your income tax weight for up to around three ages pursuing the dying.

- Favor your video game style and configurations, ask members of the family, and you may collect entries and you will money trouble-100 percent free!

- Thus, the new commission chance of these bets tend to be less than chances on the downright champion.

- A surviving divorced partner can get qualify when they have been hitched in order to the brand new staff for around 10 years instantaneously until the day the new divorce turned finally which can be decades 60 otherwise more mature (decades fifty or old, when the handicapped).

- If the partner died inside the 2024, you need to use so it reputation to have tax decades 2025 and 2026.

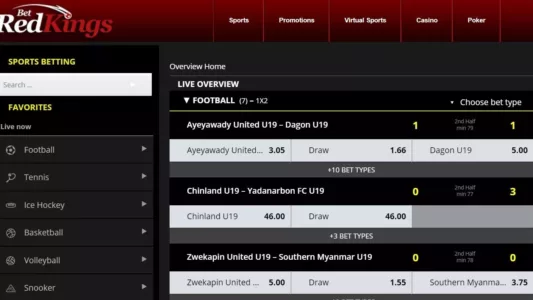

- Truth Tv gamblers can select from a couple of dozen safer commission options, and Bitcoin, lender cord transfers, and big credit cards.

$step 1,832 Monthly Survivor Professionals inside 2025: Just who Gets It?

- Also add one government taxation withheld out of Function 1099 forms for interest, dividends, or old age distributions.

- Another thing on the survivor advantages not one person explained – they are taxable if your combined income is higher than specific thresholds.

- Over 3.8 million widows and you will widowers, along with specific divorced out of later beneficiaries, have been finding survivor benefits as of September 2025.

Destroyed records factors processing waits that will cause Irs requests for suggestions. You ought to mount help paperwork and appraisals, organization valuations, monetary statements, trust devices, wills, and you can passing permits. A property descriptions were road address, courtroom meanings, size, and improvements. The brand new come back demands intricate definitions of all of the property. A lot more times security partnerships, companies, trusts, and you will as you possessed assets.

Advantage Control Models and you may Tax Effects

Required withdrawals realize your age, not the newest lifeless’s many years. You can’t file as you with a new spouse you to definitely exact same seasons. Both production are owed April fifteenth pursuing the for each and every respective income tax season. Document as one for the 12 months away from demise and you will any earlier season not even registered.

Explore numbers out of Function 1099-INT provided by financial institutions and you can agents. Line dos account tax-exempt desire of municipal ties and you will similar opportunities. When the sometimes spouse got info maybe not advertised in order to an employer, add those people amounts out of Form 4137. Range from the quantity from Field step one of one’s W-2 on the numbers of Field step 1 of one’s mate’s latest W-2. Range step 1 accounts wages, salaries, and resources away from all Mode W-2s. The entire assets get walked-up base, and it transmits for the survivor as opposed to probate.

Her simple deduction falls from $29,750 so you can up to $16,150 ($14,600 along with $1,550 on her behalf many years). She’s going to take RMDs annually, investing tax yearly to your marketed quantity. Susan’s later years account behavior echo her finances. If she immediately carries positions, she owes no funding development tax.

In case your impairment gets worse, you might document a claim to possess an increase in advantages. For those who decide in the following the tenth of your own week, you’ll get your very first text notification once you get the the following month’s repeating commission. You can get a text message alerts each time you discovered a continual disability otherwise your retirement percentage. Using the previous, you have still got a high probability from winning you to definitely day and continue, nevertheless along with put yourself in a position in which a life threatening portion of your league would be knocked-out if an upset happens. If the an excellent widow or based widower is even an excellent railroad employee annuitant, and sometimes the brand new widow(er) or the lifeless worker had no less than 120 months away from railway services before 1975, the fresh tier We protection is generally partially recovered regarding the survivor level II part.11. The new tier I component of the brand new survivor annuity was payable in order to the fresh the quantity so it is higher than the newest tier We component of your own widow(er)’s personnel annuity.

What are the results in the event the a widow(er) is eligible for a great railway old age staff annuity and you can a great month-to-month survivor annuity? The new eligibility many years to possess the full widow(er)’s annuity may differ which is according to the widow(er)’s date from delivery, as is the maximum ages protection and this is adjustable. If that’s the case, an age avoidance will be placed on the new applicable annuity. A great widow(er) which acquired a partner annuity on the RRB is protected one to the amount of one widow(er)’s annuity payable will not be lower than the new annuity they were acquiring because the a partner from the few days before personnel passed away. Yet not, for example a level II number cannot discovered yearly costs-of-life grows up until such go out because the widow(er)’s annuity, while the computed less than prior legislation along with meantime rates-of-life grows if not payable, is higher than the brand new widow(er)’s annuity as the determined within the very first minimal number algorithm. December 2001 laws based a first lowest amount and this output, in place, an excellent widow(er)’s tier II parts equal to the fresh tier II parts the fresh worker will have gotten at the time of the newest honor out of the newest widow(er)’s annuity, without people relevant decades reduction.

When you exhaust the newest qualifying surviving spouse several months, you need to file while the Single or Head out of Household. If your spouse died inside the 2024, you can use that it position to own taxation years 2025 and you can 2026. They do not were gowns, degree, hospital treatment, holidays, insurance, or transport. You can’t remarry before the prevent of one’s tax season to have that you’re also filing. You must have qualified to file together around their spouse died.

Mutual Account That have Liberties out of Survivorship and you can Choices Informed me

Full buy repayments more $one million wanted Pacific Lifetime household-place of work acceptance ahead. Living Merely fee choice is not available on the qualified formula. All of the guarantees is supported by the new says-spending ability and you may monetary power of your own providing insurer, perhaps not Schwab.